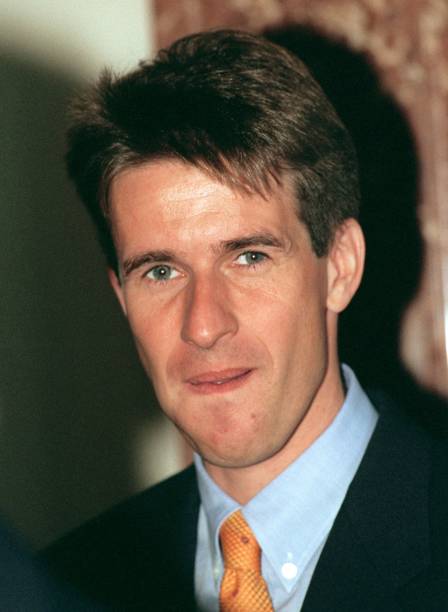

Stefan Quandt, one of Germany’s wealthiest individuals, amassed his fortune primarily through his substantial stake in BMW, the luxury automobile giant. Born into one of Germany’s most prominent business families, Quandt’s journey to wealth is both a story of inheritance and strategic business acumen.

Building Wealth: Quandt’s Key Strategies

1. Inheritance and Family Legacy: Quandt inherited a significant portion of his wealth from his father, Herbert Quandt, who was instrumental in saving BMW from bankruptcy in the 1960s. This inheritance laid the foundation for his financial empire.

2. Strategic Investments in BMW: While much of his wealth came from inheritance, Stefan Quandt played an active role in the company. He holds a substantial stake in BMW, which has grown significantly in value as the company expanded its global market share and reputation for luxury and innovation.

3. Diversification: In addition to BMW, Quandt has diversified his investments into other sectors, including technology and renewable energy. This diversification has helped stabilize his wealth and ensure continued growth.

“Preserve the legacy, innovate for the future.”

Stefan Quandt

Financial Success Tips from Stefan Quandt

1. Leverage Your Assets:

Like Quandt, identify key assets that can serve as the cornerstone of your wealth. In his case, BMW was the key asset that propelled his financial success.

2. Diversify Investments:

While holding a large stake in BMW, Quandt wisely diversified into other industries. Diversification can protect against market volatility and provide multiple streams of income.

3. Inherit and Innovate:

If you inherit wealth, use it as a foundation to innovate and grow. Quandt didn’t just rely on his inheritance; he took an active role in BMW’s success and sought out new investment opportunities.

Steps to Wealth: Following Quandt’s Example

Think Long-Term: Focus on long-term gains rather than quick wins.

Identify Your Core Asset: Focus on a core asset or industry that has long-term growth potential.

Play an Active Role: Even with inherited wealth, actively engage in growing your investments.

Diversify: Spread your wealth across multiple sectors to mitigate risk.

Innovate: Constantly look for new opportunities to expand your financial portfolio.

Secrets to Becoming Rich Like Stefan Quandt

- Strategic Patience: Quandt didn’t rush into decisions. His wealth grew as he patiently managed and expanded his investments.

- Innovation within Tradition: Quandt respected the legacy of BMW but also sought out innovative approaches to grow the company.

Achieving Financial Freedom: Lessons from Stefan Quandt

Stefan Quandt’s journey to financial success offers valuable lessons in leveraging inherited wealth, strategic investments, and diversification. By applying these principles, anyone can build a solid foundation for long-term wealth and financial freedom.

Conclusion: Stefan Quandt’s path to wealth is a testament to the power of strategic asset management, diversification, and innovation. Whether you’re seeking tips to get rich, strategies for wealth building, or a roadmap to financial independence, Quandt’s story provides a valuable blueprint. Follow these strategies, and you too can achieve financial success in your chosen field.

Embrace these principles and take the first step today. Stay motivated, stay focused, and keep learning.

For more insights and tips on building wealth, explore our other articles and unlock your potential to become rich only here at www.richtactics.com. Your future begins now!