Jim Simons, the mathematician-turned-hedge fund manager, revolutionized the finance world with his quantitative approach to investing. Founder of Renaissance Technologies, Simons built a fortune by leveraging mathematical models and algorithms to predict market trends. His journey from academia to becoming one of the wealthiest individuals in finance offers valuable insights for those aspiring to achieve wealth and financial independence. In this blog, we’ll explore how Jim Simons became rich and provide actionable tips and strategies for creating your own path to financial success.

How Jim Simons Became Rich

Academic Career and Early Life

Jim Simons was born in 1938 in Newton, Massachusetts. He showed an early aptitude for mathematics, earning a bachelor’s degree from the Massachusetts Institute of Technology (MIT) and a Ph.D. from the University of California, Berkeley. He worked as a codebreaker for the National Security Agency and later became a renowned mathematician, known for his work in geometry and topology.

“Think rigorously, act wisely, and always seek the truth.”

Jim Simons

Transition to Finance and Founding Renaissance Technologies

In 1978, Simons left academia to pursue a career in finance. He founded Renaissance Technologies in 1982, a quantitative hedge fund that used mathematical models to predict and capitalize on market movements. Simons’ innovative approach combined mathematics, statistics, and computer science, allowing Renaissance to consistently outperform traditional investment strategies.

The Success of the Medallion Fund

Renaissance Technologies’ flagship fund, the Medallion Fund, achieved unprecedented success, with average annual returns of over 66% before fees. The fund’s proprietary algorithms and data-driven approach enabled it to navigate market volatility and generate significant profits. The Medallion Fund’s success made Simons one of the wealthiest individuals in finance.

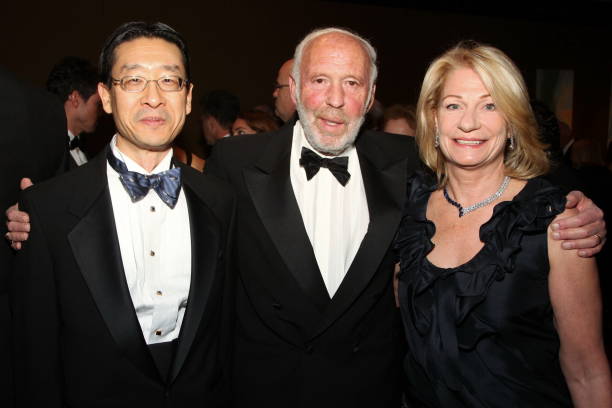

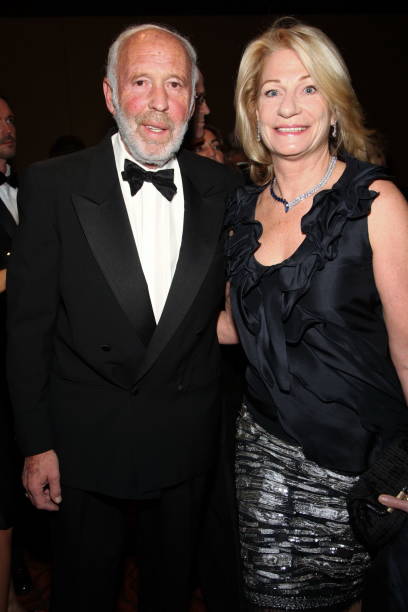

Philanthropy and Scientific Research

Beyond his financial success, Jim Simons is a committed philanthropist. He founded the Simons Foundation, which supports research in mathematics, science, and education. Through his philanthropic efforts, Simons has contributed to advancing scientific knowledge and supporting educational initiatives.

Tips for Getting Rich: Inspired by Jim Simons

1. Leverage Expertise and Innovation

- Tip: Utilize your expertise and innovative thinking to identify unique opportunities.

- Strategy: Like Simons, apply your skills and knowledge to create innovative solutions in your chosen field.

2. Embrace Data-Driven Decision Making

- Tip: Use data and analytics to guide your investment and business decisions.

- Strategy: Develop data-driven strategies to optimize your financial outcomes and minimize risk.

3. Continuously Learn and Adapt

- Tip: Stay curious and continuously seek new knowledge and skills.

- Strategy: Embrace lifelong learning to adapt to changing market conditions and discover new opportunities.

4. Build a Strong Team

- Tip: Surround yourself with talented individuals who complement your skills and vision.

- Strategy: Collaborate with experts in various fields to enhance your capabilities and drive success.

5. Give Back to Society

Strategy: Engage in philanthropic activities that support causes you care about and contribute to the greater good.

Tip: Use your wealth and influence to make a positive impact on society.

Steps to Wealth: Implementing Jim Simons’ Strategies

- Leverage Expertise: Utilize your skills and innovative thinking to identify unique opportunities.

- Embrace Data-Driven Decisions: Use data and analytics to guide your financial strategies.

- Continuously Learn: Stay curious and continuously seek new knowledge and skills.

- Build a Team: Collaborate with talented individuals to enhance your capabilities.

- Give Back: Engage in philanthropic activities to support causes you care about.

Financial Success Tips: Secrets to Becoming Rich

- Innovative Thinking: Develop innovative solutions and strategies to gain a competitive edge.

- Data Utilization: Leverage data and analytics to optimize your investment and business decisions.

- Risk Management: Implement effective risk management strategies to protect your wealth.

- Network Building: Build a strong network of advisors, mentors, and industry experts.

Get Rich Quick Ideas: Balancing Risk and Reward

While quick wealth is rare, high-risk, high-reward opportunities include:

- Startups: Invest in or start high-growth startups.

- Cryptocurrency: Explore cryptocurrency trading or investment.

- High-Growth Sectors: Invest in emerging sectors with significant growth potential.

Conclusion: Achieving Financial Independence

Jim Simons’ journey from mathematics to financial success highlights the importance of leveraging expertise, embracing innovation, and continuously learning. By applying these principles and implementing the tips and strategies outlined above, you can create a roadmap to financial success and independence.

Start today by setting clear goals, seeking diverse investment opportunities, and continuously pursuing growth and innovation. Your journey to wealth and financial freedom begins with the first step.

By following the wealth-building strategies of successful individuals like Jim Simons, you can craft your path to financial success and independence. Building wealth requires dedication, strategic thinking, and a willingness to innovate. Stay focused on your goals, and success will follow.

Proving that with bold ideas and determination, anything is possible.

Embrace these principles and take the first step today. Stay motivated, stay focused, and keep learning.

For more insights and tips on building wealth, explore our other articles and unlock your potential to become rich only here at www.richtactics.com. Your future begins now!